Saturday, April 15, 2006

The Technique

I've just finished reading Sure-Fire Forex Trading written by Mark McRae. The main insight gained from the book is the Dow Theory which Charles Dow's interpreted that in a trend, each rally high will be higher than the previous rally high or each rally low will be lower than the previous rally low.

Dow also theorized that there are three types of trends:

According to Dow, the trend has three phases:

And the last major part of the theory is the trend should be assumed to still be in force until there is a definite indication that the direction has in fact changed.

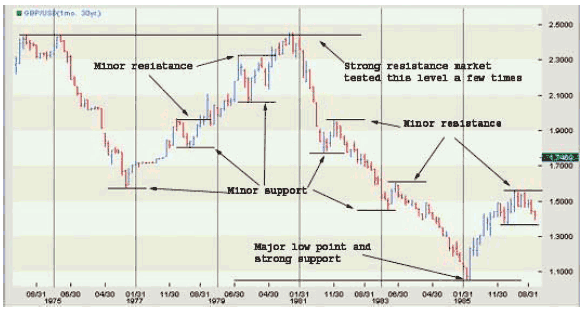

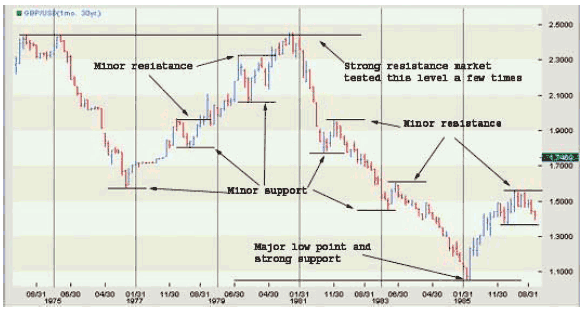

McRae continues with support and resistance pattern stating that when the market moves up and then pulls back, the highest point it reached before it pulled back is now resistance. As the market continues up again, the lowest point it reached before it started to pull back up is now support. In this way, resistance and support are continually formed as the market oscillates over time.

Two interesting points that he noted are:

Using the Dow Theory and the concept of support and resistance, it is not too difficult to predict the movement of any exchanged rate if we study the historical chart of the particular currency pair because we understand that prices move in recognizable patterns.

McRae then revealed the 'Sure-Fire' Forex trading technique using Exponential Moving Average (EMA) of 89 and 144 period and Fibonacci ratios of 38.2% and 61.8% to predict with high probability the targets which we could use to plan our trades.

I will be using his methods soon with a demo account. I would highly recommend the e-book for those who would like to have a clearer view of Forex trading.

Dow also theorized that there are three types of trends:

- Primary trend: the main force, may take years to come to an end and develops over time

- Secondary trend as tributary to the main trend and can take anywhere from a few weeks to a few months in duration

- Minor trend, such as daily trends which could last a few days or so and are of little significance

According to Dow, the trend has three phases:

- An accumulation stage

- The public participation stage

- The distribution stage

And the last major part of the theory is the trend should be assumed to still be in force until there is a definite indication that the direction has in fact changed.

McRae continues with support and resistance pattern stating that when the market moves up and then pulls back, the highest point it reached before it pulled back is now resistance. As the market continues up again, the lowest point it reached before it started to pull back up is now support. In this way, resistance and support are continually formed as the market oscillates over time.

Two interesting points that he noted are:

- When the market passes through resistance, that resistance now becomes support.

- The more often price tests a level of resistance or support without breaking it, the stronger the area is.

Using the Dow Theory and the concept of support and resistance, it is not too difficult to predict the movement of any exchanged rate if we study the historical chart of the particular currency pair because we understand that prices move in recognizable patterns.

McRae then revealed the 'Sure-Fire' Forex trading technique using Exponential Moving Average (EMA) of 89 and 144 period and Fibonacci ratios of 38.2% and 61.8% to predict with high probability the targets which we could use to plan our trades.

I will be using his methods soon with a demo account. I would highly recommend the e-book for those who would like to have a clearer view of Forex trading.