Monday, April 24, 2006

The Global Imbalances

USD is very bearish at the moment and being battered across the board. It is at it's 7-month low. EURUSD is reading a high 1.24 while USDJPY is at a low 114.

A major reason for the dip contributed by the G7 strong comments on currency flexibility and global imbalances. Central banks of many countries are diversifying their forex reserves, selling off USD and putting them in EUR and other currencies.

It would be an interesting time to trade, but as I am travelling and don't have my trading station with me to do the technical analysis (I wish I had brought my notebook with me).

Nonetheless, I'll make a point to watch Ben Bernake, the new Fed Chairman, testify in Washington this Thursday on the state of the US economy. His remarks would fuel further price movement in either directions.

A major reason for the dip contributed by the G7 strong comments on currency flexibility and global imbalances. Central banks of many countries are diversifying their forex reserves, selling off USD and putting them in EUR and other currencies.

It would be an interesting time to trade, but as I am travelling and don't have my trading station with me to do the technical analysis (I wish I had brought my notebook with me).

Nonetheless, I'll make a point to watch Ben Bernake, the new Fed Chairman, testify in Washington this Thursday on the state of the US economy. His remarks would fuel further price movement in either directions.

Sunday, April 23, 2006

The Switch

I'm having second thoughts about depositing my money with FXCM after reading what other traders are saying about retail brokers.

There are reports of fraudulent activities such as stop hunting (spiking the price to trigger your stop loss) and trading against their customers using the advantages that they have.

From the above thread, InterbankFX seems to be the least evil among the retail brokers. They've received some pretty good testimonials from satisfied traders. They are also using MetaTrader4 as the trading station which allows a Windows Mobile usesr like me to trade on the go.

As soon as I managed to spare USD500 I'll open an account with them. I'm glad I didn't get started with FXCM. I believe it would have been a complete waste of USD300. It's always adviceable to check out what others are saying before putting your money with retail broker. Ultimately, once you have enough money (USD50-100k), it's time to go with the bigger brokers.

There are reports of fraudulent activities such as stop hunting (spiking the price to trigger your stop loss) and trading against their customers using the advantages that they have.

From the above thread, InterbankFX seems to be the least evil among the retail brokers. They've received some pretty good testimonials from satisfied traders. They are also using MetaTrader4 as the trading station which allows a Windows Mobile usesr like me to trade on the go.

As soon as I managed to spare USD500 I'll open an account with them. I'm glad I didn't get started with FXCM. I believe it would have been a complete waste of USD300. It's always adviceable to check out what others are saying before putting your money with retail broker. Ultimately, once you have enough money (USD50-100k), it's time to go with the bigger brokers.

Thursday, April 20, 2006

The Dark Side

It's good to be careful and have a thorough check of any forex broker before we make our first deposit and start trading. The following Wikipedia article highlights the dark side of the forex brokering business.

Forex Scams

Since forex broker always have an upper hand, we would be at their mercy most of the time. And it is a merciless zero-sum game. There'll always be winners and losers. And I am still trying to justify to myself, what value would I contribute to humanity by trading forex?

I hope I would eventually find an answer to that.

Forex Scams

Since forex broker always have an upper hand, we would be at their mercy most of the time. And it is a merciless zero-sum game. There'll always be winners and losers. And I am still trying to justify to myself, what value would I contribute to humanity by trading forex?

I hope I would eventually find an answer to that.

Tuesday, April 18, 2006

The First Paper Trading Hit

On paper, I entered the market at 1.2272. EUR/USD continued to rally up as expected and it hit our target of 1.2348 4.5 hours later.

On paper, it was a 77-pip gain, which on a mini-account leveraged trading of USD10k, it would have been a USD77 profit. Not too bad for a day's work. And if it was on a proper account leveraging USD100k, it would have been a USD770 profit.

Most importantly, the technical analysis helped tonnes. Coupled with strong fundamentals, the market behaved exactly how we predicted it to be.

Eventhough it was only a paper trade, I gained a valuable experience through the practice. I went through a bit of the predicted emotional turmoil or fear, uncertainty and doubt (FUD) but I was able to see things as they are and not let emotions get in the way. Upon hitting the target, there was the usual euphoria, and I quickly calmed myself down. The varying emotions would have been magnified tenfold with a real trading account, and the ability to keep oneself calm and collected going through the emotional rollercoaster ride would be the determining factor to separate the successful traders from the novice.

As I have reminded myself hundreds of times, life is a game and it is all in the mind. Play it well and play it joyfully. With that, I would like to thank Abg Hashim for introducing me to forex and for his inspiration, support and education. Forex trading is one exciting game.

On paper, it was a 77-pip gain, which on a mini-account leveraged trading of USD10k, it would have been a USD77 profit. Not too bad for a day's work. And if it was on a proper account leveraging USD100k, it would have been a USD770 profit.

Most importantly, the technical analysis helped tonnes. Coupled with strong fundamentals, the market behaved exactly how we predicted it to be.

Eventhough it was only a paper trade, I gained a valuable experience through the practice. I went through a bit of the predicted emotional turmoil or fear, uncertainty and doubt (FUD) but I was able to see things as they are and not let emotions get in the way. Upon hitting the target, there was the usual euphoria, and I quickly calmed myself down. The varying emotions would have been magnified tenfold with a real trading account, and the ability to keep oneself calm and collected going through the emotional rollercoaster ride would be the determining factor to separate the successful traders from the novice.

As I have reminded myself hundreds of times, life is a game and it is all in the mind. Play it well and play it joyfully. With that, I would like to thank Abg Hashim for introducing me to forex and for his inspiration, support and education. Forex trading is one exciting game.

Monday, April 17, 2006

The First Prediction

I started watching EUR/USD movement yesterday and it made a jump of over 100 pips.

Some people must have made a huge sum of profit, and likewise, some must have lost tonnes. I've not made any technical analysis on where the pair is heading. But the MACD indicator is telling us to sell, thus tomorrow I bet the pair is going to move south.

Let's come back to this in 24 hours and see if my first money-free bet works out.

-Update-

Ooops, I couldn't wait 24 hours to see how my prediction turns out. Especially after reading that USD is weak and continues to slide down. EUR/USD moved up and broke the previous resistance of 1.2301 and it is currently pulling back for a breather. I've calculated the entry point to be 1.2272 and target it to reach 1.2348 for a 77-pip gain. With a bit of waiting, it might even go up to 1.2396 for a 125-pip profit.

I'll have to set my stop loss at the 61.8% retracement level at 1.2253 and risk 18 pips. I could do all this if I have a trading account. Since I don't, let's see how it would turn out. 18 pip lost or 77 pip gain? We'll find out soon.

Some people must have made a huge sum of profit, and likewise, some must have lost tonnes. I've not made any technical analysis on where the pair is heading. But the MACD indicator is telling us to sell, thus tomorrow I bet the pair is going to move south.

Let's come back to this in 24 hours and see if my first money-free bet works out.

-Update-

Ooops, I couldn't wait 24 hours to see how my prediction turns out. Especially after reading that USD is weak and continues to slide down. EUR/USD moved up and broke the previous resistance of 1.2301 and it is currently pulling back for a breather. I've calculated the entry point to be 1.2272 and target it to reach 1.2348 for a 77-pip gain. With a bit of waiting, it might even go up to 1.2396 for a 125-pip profit.

I'll have to set my stop loss at the 61.8% retracement level at 1.2253 and risk 18 pips. I could do all this if I have a trading account. Since I don't, let's see how it would turn out. 18 pip lost or 77 pip gain? We'll find out soon.

The Winning Example

FXCM just announced the winners of their monthly mini-account contests for March.

The trader who won the first price made close to USD7,000 with an intial account balance of just over USD1,000.

Using Moving Average Convergence/Divergence (MACD) buy and sell indicators, she was able to catch large moves of momentum.

Her trading record for March is listed here.

Of course, for every winning case such as hers, there are hundreds of losing ones. But with proper education, training, discipline and self-control, there's no reason not being able to follow her example.

The trader who won the first price made close to USD7,000 with an intial account balance of just over USD1,000.

Using Moving Average Convergence/Divergence (MACD) buy and sell indicators, she was able to catch large moves of momentum.

Her trading record for March is listed here.

Of course, for every winning case such as hers, there are hundreds of losing ones. But with proper education, training, discipline and self-control, there's no reason not being able to follow her example.

Sunday, April 16, 2006

The Fictionalized Biography

As I was browsing a Forex forum on ForexFactory, I came across a recommendation from a fellow participant for a true financial classic titled Reminiscences Of A Stock Operator by Edwin LeFevre.

First published in 1923, the fictionalized biography of immortal speculator Jesse Livermore, is timeless because "it accurately captures the mind of a trader--the recollections of mistakes made, the lessons learned, the insights gained."

Some valuable quotes from the book:

'I did precisely the wrong thing. The cotton showed me a loss and I kept it. The wheat showed me a profit and I sold it out. Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.'

'Things got worse and worse. Finally there came the awful day of reckoning for the bulls and the optimists and the wishful thinkers and those vast hordes that, dreading the pain of a small loss at the beginning, were now about to suffer total amputation -- without anaesthetics. A day I shall never forget, October 24, 1907.'

'Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit.'

First published in 1923, the fictionalized biography of immortal speculator Jesse Livermore, is timeless because "it accurately captures the mind of a trader--the recollections of mistakes made, the lessons learned, the insights gained."

Some valuable quotes from the book:

'I did precisely the wrong thing. The cotton showed me a loss and I kept it. The wheat showed me a profit and I sold it out. Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.'

'Things got worse and worse. Finally there came the awful day of reckoning for the bulls and the optimists and the wishful thinkers and those vast hordes that, dreading the pain of a small loss at the beginning, were now about to suffer total amputation -- without anaesthetics. A day I shall never forget, October 24, 1907.'

'Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit.'

Saturday, April 15, 2006

The Technique

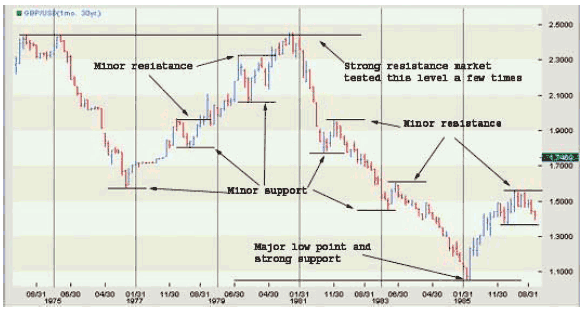

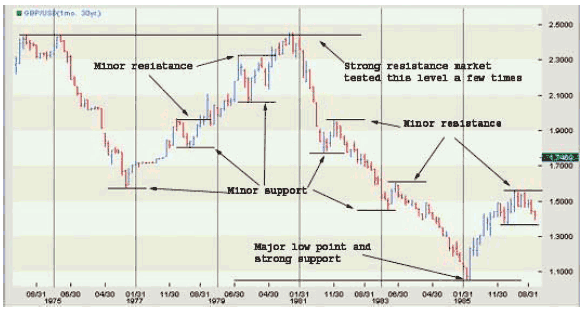

I've just finished reading Sure-Fire Forex Trading written by Mark McRae. The main insight gained from the book is the Dow Theory which Charles Dow's interpreted that in a trend, each rally high will be higher than the previous rally high or each rally low will be lower than the previous rally low.

Dow also theorized that there are three types of trends:

According to Dow, the trend has three phases:

And the last major part of the theory is the trend should be assumed to still be in force until there is a definite indication that the direction has in fact changed.

McRae continues with support and resistance pattern stating that when the market moves up and then pulls back, the highest point it reached before it pulled back is now resistance. As the market continues up again, the lowest point it reached before it started to pull back up is now support. In this way, resistance and support are continually formed as the market oscillates over time.

Two interesting points that he noted are:

Using the Dow Theory and the concept of support and resistance, it is not too difficult to predict the movement of any exchanged rate if we study the historical chart of the particular currency pair because we understand that prices move in recognizable patterns.

McRae then revealed the 'Sure-Fire' Forex trading technique using Exponential Moving Average (EMA) of 89 and 144 period and Fibonacci ratios of 38.2% and 61.8% to predict with high probability the targets which we could use to plan our trades.

I will be using his methods soon with a demo account. I would highly recommend the e-book for those who would like to have a clearer view of Forex trading.

Dow also theorized that there are three types of trends:

- Primary trend: the main force, may take years to come to an end and develops over time

- Secondary trend as tributary to the main trend and can take anywhere from a few weeks to a few months in duration

- Minor trend, such as daily trends which could last a few days or so and are of little significance

According to Dow, the trend has three phases:

- An accumulation stage

- The public participation stage

- The distribution stage

And the last major part of the theory is the trend should be assumed to still be in force until there is a definite indication that the direction has in fact changed.

McRae continues with support and resistance pattern stating that when the market moves up and then pulls back, the highest point it reached before it pulled back is now resistance. As the market continues up again, the lowest point it reached before it started to pull back up is now support. In this way, resistance and support are continually formed as the market oscillates over time.

Two interesting points that he noted are:

- When the market passes through resistance, that resistance now becomes support.

- The more often price tests a level of resistance or support without breaking it, the stronger the area is.

Using the Dow Theory and the concept of support and resistance, it is not too difficult to predict the movement of any exchanged rate if we study the historical chart of the particular currency pair because we understand that prices move in recognizable patterns.

McRae then revealed the 'Sure-Fire' Forex trading technique using Exponential Moving Average (EMA) of 89 and 144 period and Fibonacci ratios of 38.2% and 61.8% to predict with high probability the targets which we could use to plan our trades.

I will be using his methods soon with a demo account. I would highly recommend the e-book for those who would like to have a clearer view of Forex trading.

Thursday, April 13, 2006

The Nudge

Received another long distance call again today from FXCM.com. Despite their previous letter of caution, they really like me to start trading. Pretty aggressive marketing on their part, I would say.

The next thing I actually have to do is to scan my ID and proof of residence and mail it to admin@fxcm.com. Next is to actually enter my credit card info on their website to deposit at least USD300 for a mini-account.

He also introduced me to a new site from them at http://www.fxcmtr.com/ which could be helpful in making a trade. I've yet to explore the site to make any good review on it.

I'm on the third chapter of the forex trading e-book I'm reading. Just finishing the introductory lessons and now moving into technical analysis. Juggling myself between work and life in general, I'm not making as much progress on the book as I would like to. But I'm moving forward nonetheless. That's the only way to go.

The next thing I actually have to do is to scan my ID and proof of residence and mail it to admin@fxcm.com. Next is to actually enter my credit card info on their website to deposit at least USD300 for a mini-account.

He also introduced me to a new site from them at http://www.fxcmtr.com/ which could be helpful in making a trade. I've yet to explore the site to make any good review on it.

I'm on the third chapter of the forex trading e-book I'm reading. Just finishing the introductory lessons and now moving into technical analysis. Juggling myself between work and life in general, I'm not making as much progress on the book as I would like to. But I'm moving forward nonetheless. That's the only way to go.

Wednesday, April 12, 2006

The 45 Things to Avoid

Here's a good article from Eurustrader.com.

45 Ways to Avoid Losing Money on Forex Trading

Demo accounts, over-leveraging, over dependence on others, lack of emotional control and under-knowledge are some of the ways listed and described in the article. Go and have a read.

45 Ways to Avoid Losing Money on Forex Trading

Demo accounts, over-leveraging, over dependence on others, lack of emotional control and under-knowledge are some of the ways listed and described in the article. Go and have a read.

Tuesday, April 11, 2006

The Introductory Lessons

I usually trust Wikipedia for their definitions of terms and articles. Here's what they say about forex which is a good place to start learning about the foreign exchange market.

Once we've covered the basics, the next is to scour the wealth of articles available on FXStreet.com

I've only started on a couple of articles, but I should be keeping myself busy in the next few weeks reading them all and completing the forex books I have. I'll be sharing some of the articles in greater details once I get to them.

Once we've covered the basics, the next is to scour the wealth of articles available on FXStreet.com

I've only started on a couple of articles, but I should be keeping myself busy in the next few weeks reading them all and completing the forex books I have. I'll be sharing some of the articles in greater details once I get to them.

The First Account

I registered myself for a forex trading account at Forex Capital Market, it being the most visually attractive forex trading site which I found. I suppose my major reason is that the company doesn't require a hugh capital to get started.

After answering their survey questions, I received an e-mail from them:

What they are saying is that I'm a novice (which I already know I am) and that I might lose all my money in forex trading. I'm not about to quit over the e-mail, but I do need to carefully study what I'm getting into.

However, they did call me over the phone to ask if I'm going to make the deposit into my account, which is USD300 for a mini-account. That I should be able to raise in a couple of weeks. In the mean time, I have a few books on forex trading I'll be reading to educate myself and prepare for an actual trade. There's also demo accounts on FXCM websites for me to test out my trading skills and see if I'd actually crash and burn with the USD300.

There is also a local forex trading company which I'll be visiting soon. Their requirement to open an account is USD10,000. With a bit of determination and discipline, that should be achievable within the next several months. Wish me luck!

After answering their survey questions, I received an e-mail from them:

- "Welcome and thank you for choosing Forex Capital Markets LLC (“FXCM”). FXCM is committed to the practice of the highest standards of commercial honor and just and equitable principles of trade. As a part of our ongoing commitment to regulatory compliance, there are certain occasions where FXCM feels obliged or may be required to inform clients of the high risk involved in currency trading.

FXCM reviews various criteria on the account application. Based on your responses to questions on the application, we have identified that you fall into one of the categories below and encourage you to consider whether trading currencies is a suitable investment for you.

After reading the disclosures below, if you decide that you still want to open a trading account, simply follow the funding instruction provided to you in another email notice from us or from our website to fund your new account. You do not have to respond to FXCM to continue your account opening process.

You have fallen into one or more of these categories:

1. Age - 18 to 21 years of age

2. Age - 65 years of age or over

3. Currently Retired

4. Currently Unemployed

5. Filed Bankruptcy

6. Annual Income under $25,000

7. Net Worth under $25,000

8. Liquid Assets under $25,000

9. Trading Experience – No Experience in all 5 Trading categories

10. IRA account, i.e. retirement funds used as risk capital

Based on the above said criteria FXCM believes that in your case leveraged foreign exchange trading may be too risky. Please take the time to consider this matter carefully before deciding to complete the account application process.

If you have pursued only conservative forms of investment in the past, you may wish to study currency trading further before continuing an investment of this nature. You must realize that you could sustain a total loss of all funds you deposit with your broker as initial margin as well as substantial amounts of capital, when trading currencies or currency options, should the market go against your investment. You must also realize that the limited risk in buying options means you could lose the entire option investment should the option expire worthless.

Additionally, you must fully understand the nature and risks of currency and currency options investments. You should not proceed with your investment if you will be unable to meet your obligations to others should you suffer investment losses."

What they are saying is that I'm a novice (which I already know I am) and that I might lose all my money in forex trading. I'm not about to quit over the e-mail, but I do need to carefully study what I'm getting into.

However, they did call me over the phone to ask if I'm going to make the deposit into my account, which is USD300 for a mini-account. That I should be able to raise in a couple of weeks. In the mean time, I have a few books on forex trading I'll be reading to educate myself and prepare for an actual trade. There's also demo accounts on FXCM websites for me to test out my trading skills and see if I'd actually crash and burn with the USD300.

There is also a local forex trading company which I'll be visiting soon. Their requirement to open an account is USD10,000. With a bit of determination and discipline, that should be achievable within the next several months. Wish me luck!

The Call

What started as a casual conversation has sparked a new interest in me and hopefully will eventually turn into a passionate money-making hobby. Abg Hashim is getting into Forex trading and he has convinced me to join forces.

I started some readings at RapidForex.com and FXStreet.com getting introductory lessons on pips, margin, spreads and all.

I'm a reader of Robert Kiyosaki, and being a successful investor has always been my ultimate goal. I'd like to try Forex over the stock market because:

I believe I could be a successful trader because:

I hope to use this blog to log my trading activities and keep a tab on my gains and losts. At the same time, I hope to share my knowledge and experiences as I gain them in the market.

I started some readings at RapidForex.com and FXStreet.com getting introductory lessons on pips, margin, spreads and all.

I'm a reader of Robert Kiyosaki, and being a successful investor has always been my ultimate goal. I'd like to try Forex over the stock market because:

- Forex is too big to be manipulated.

- The forex market is open virtually 24 hours.

- Government and people have the actual need to exchange currency, while people purchase stocks not out of need.

I believe I could be a successful trader because:

- I have good control of my emotions

- I'm focused on the now

- I don't worry much

- I don't fear much

- I have good management skills which I could apply to investments and money management

I hope to use this blog to log my trading activities and keep a tab on my gains and losts. At the same time, I hope to share my knowledge and experiences as I gain them in the market.